Credit cards and plastic money in general have become extremely ubiquitous with the passage of time because they so incredibly convenient. You don't need to whip out some paper money every time you go out for your groceries, just let the credit card deal with all your worries. But credit cards are not without their risks, here's what you should know about credit cards before making a transaction.

Credit cards come with a large number of benefits. The most important of which is to actually build your credit. A good credit can help you obtain loans such as a mortgage plan on favorable rates and avoid utility deposits.

There are two types of credit cards. Secured and unsecured. Secured cards are protected by a cash deposit and are equal to the maximum limit which can be withdrawn. This is collateral. Unsecured cards are not backed by any collateral and are more risky.

If the card's annual percentage is about 20% then the interest rate is going to be 0.0548%. The periodic interest rate will be calculated by dividing the APR with 365 days. Multiply that your average daily balance and the number of days in the month which accrued all that interest.

Credit card fraud is a serious problem which plagues plastic money in general. This includes fraud of all kind such as unauthorized opening of new credit cards and even the recent Equifax data breach which affected 145 million people.

The number of identity fraud victims in the United States alone includes an all time high of 15.4 million people, the fraud losses accrued to more than $16 billion by 2016. This just shows how incredibly easy it is to get victimized.

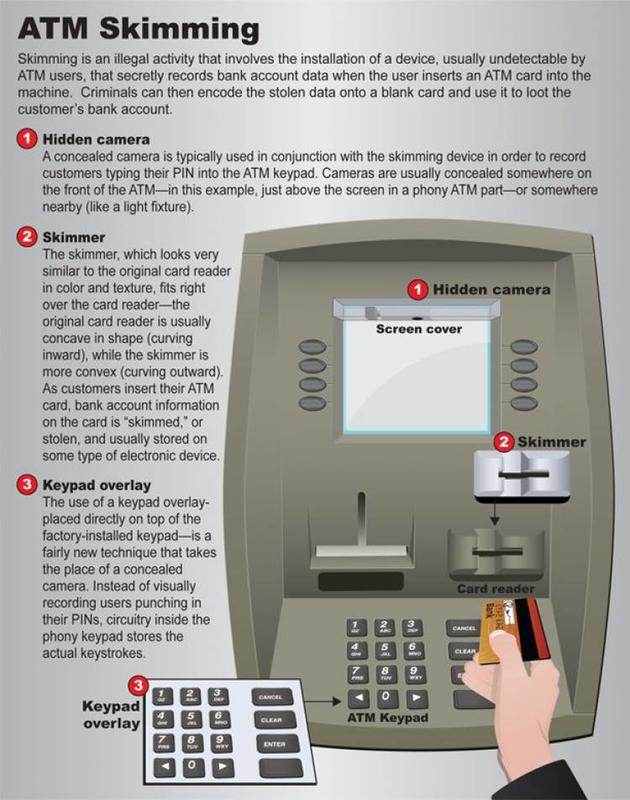

Phishing and skimming are the most popular methods which criminals use to steal your credit card numbers. You should learn to protect yourself from such tactics. Consider deploying an 'autopay and every day' strategy, which designates two different cards for auto pay and every day payments.

IF you feel that you've become vulnerable to identity theft, freeze your reports now to prevent criminals from opening new accounts under your name. Also keep an eye on all currently open accounts because they will still be active and open to purchases.

This goes without saying that you need to contact the police and all the major credit card bureaus such as Equifax, Transunion and Experian. Notify the credit card issuer such as your bank and keep track of all your conversations with the issuing authority.

You should familiarize yourself with the size parameters of the skimming terminal. If it is larger than normal it means you should likely not put your credit card in there and bolt out of the place, opt to pay with cash instead.

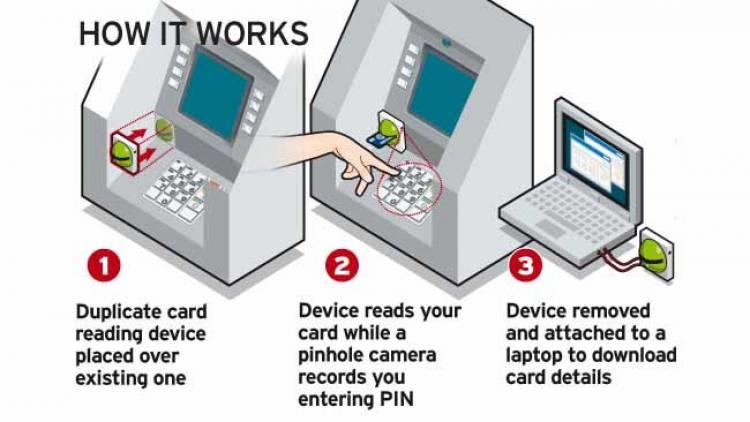

It is so convenient to pay by credit at the gas station but ATMS and vending machines are common places which criminals target. All they do is place a small device over the reader which will record your data.

Criminals cannot install their skimming devices without tampering with the existing terminal in one form or another. It is important to familiarize yourself with the overall look of the terminal and identify if it has been tampered with.

Different color material, graphics which aren't aligned properly, the speakers, side of the screen and the card reader itself can give away if a criminal has been tampered with the device. It also helps to listen to your own gut feeling.

Criminals are known to install hidden cameras and try to learn your PIN sequence. What you can do alternatively is to hide it with your hand to block the line of sight of the camera to learn the PIN sequence.

ATMS and gas pumps have very solid construction and don't have loose parts. To check if the ATM has been compromised, pull on the card reader to make sure it is firmly attached and secured in one piece.

Once you have entered the PIN number and completed the transaction, you should retype a different set of numbers on the PIN. This is because the heat signature of your fingers rub off on the pad and can give away the sequence.